Digital access to finance

“Previously, I used to save only once a month because travelling to my SACCO branch was expensive. I would first accumulate the savings in cash, a task that was very difficult. With MSACCO now, I save daily, and have been able to access credit due to my improved cash flow”

Rehema Behayo, an MSACCO Subscriber, Sheema district, UgandaBACKGROUND

Because of the way they are structured, conventional SACCOs make borrowing for farmers very expensive. There is an urgent need to enhance the capacity of SACCOs to serve rural farmer communities through simple and affordable self-service digital channels. By automating 300 SACCOs through a digital platform, FLT has made borrowing dramatically cheaper for smallholder farmers

WHAT’S INVOLVED

FLT has built a financial infrastructure comprising a shared Core Banking system (Savings Plus), an Omnichannel Payment Gateway (MSACCO), data center, inter-branch network and servers, together with a toll-free Customer Care Centre. By pooling resources, FLT has reduced each individual branch’s monthly infrastructure maintenance costs from US$500 to US$18.

EXPLORE THIS SOLUTION

As of 31 October 2020:

- 300 SACCO units had been automated

- 520,464 farmers had been served (29 per cent of whom were women)

- 281,329 individuals had subscribed to different digital financial services through MSACCO

- Aggregate savings for all farmer members had grown from US$35.2 million in January 2020 to US$40.9 million, an increase of 16.3 per cent

- Savings per member grew from US$73 in January 2020 to $79, an 8.2 per cent growth

- FLT believes that this growth is attributable to improvements in farming productivity and incomes that have resulted from enhanced access to specific financial products appropriately designed by community SACCOs.

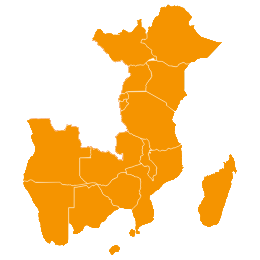

Countries involved

Uganda

Project partners

FSD Uganda; Mastercard Foundation Fund for Rural Prosperity; Interswitch; MTN; Airtel; Uganda Central Cooperative Financial Services (UCCFS); ABI TrustProject for Financial Inclusion in Rural Areas (PROFIRA)

Project dates

2018 - present

Share this solution

Bookmark this solution

BookmarkShow Full Solution

Summary

Future Link Technologies (FLT) leverages the relevance and network of Savings and Credit Co-Operative Societies (SACCOs) to accelerate the adoption of digitalfinancial services in rural farmer communities. These services enable farmers to grow their personal savings, access credit and make payments with ease andconvenience.The digital solution achieves this by:

- Automating 300 SACCOs in Uganda through a shared platform, therebyreducing the individual branch maintenance costs from US $500 to US $18 permonth.

- Exposing 630,000 farmers to the different MSACCO digital financial services. MSACCO is a mobile banking facility that enables SACCO members to depositand withdraw money using cellphone apps provided by MTN or Airtel.

- Promoting the growth of personal savings and access to credit, supported bya Helpline Customer Care Centre that responds to farmers queries andconcerns.

The Challenge/Problem

Seven out of every one hundred Africans, including babies and the elderly,belong to a cooperative. Through cooperatives, communities have spearheadedinitiatives that remove barriers to finance, markets and enhanced production. Despite the vast network of SACCOs in Africa, limited financial and human resources have constrained their reach and impact. Their limited capacity to mobilize savings and extend credit has left farmer communities vulnerable to expensive borrowing from moneylenders, whose monthly interest rates can be ashigh as 20 per cent. The farmers who try to borrow from generic financialinstitutions are often rejected or unable to access financial products tailored to their agricultural activities. There is an urgent need to enhance the capacity of SACCOs to serve ruralfarming communities through simple, secure, efficient and affordable self-service digital channels.

Solution

Future Link Technologies (FLT) has built a digital finance platform for SACCOs that, in Uganda, has reducedindividual branch’s maintenance costs from US$500 to US$18. The platform includes a mobile banking feature that enables farmers to deposit, withdraw and check balances and mini statements, even while using simple feature phones. This enables smallholders like Mr Kebirungi Leonard, a farmer from Sheema district who has a walking disability, to make key financial decisions from the convenience of his home.

FLT also enables SACCOs to provide digital marketing channels that stimulate members’ participation and transaction activity, while MSACCO makes it easier for members to carry out cost-effective transactions on their mobile phones.

Previously, if farmers wanted to deposit money into their accounts, they would have needed to leave theirfarms and spend time and money travelling to the closest SACCO branch. With MSACCO, farmers can addmoney to their phones for free at mobile money agents and then transfer the funds directly to their SACCO accounts with only minimal fees. For a $5.55 deposit, the total charge would be $0.40: $0.13 tothe Mobile Network Operator (MNO), $0.16 to the SACCO and $0.11 to FLT. These fees are significantly less than the approximately $1.25 it would have cost to travel to the SACCO branch in person.

This mobile money transfer is therefore cheaper, faster, more secure and more convenient for farmers. Using MSACCO reduces farmers’ risks of cash theft, impulse purchases and exposure to COVID-19.Additionally, users will soon access other relevant financial, market, and health services. The savingsfrom SACCOs’ reduced operating costs are passed along to their members as dividends. For a typicalSACCO of 500 members, each member earns an additional $5.78 per annum (7.9 per cent) from an average saving of $73.

Results

As of 31 October 2020:

- 300 SACCO units had been automated

- 520,464 farmers had been served (29 per cent of whom were women) on the digital system

- 281,329 individuals had subscribed to different digital financial services through MSACCO

- Aggregate savings for all farmer members had grown from US$35.2 million in January 2020 to US$40.9 million, an increase of 16.3 per cent

- Savings per member grew from an average of US$73 in January 2020 to $79, an 8.2 per cent increase

FLT believes that this growth is attributable to improvements in farming productivity and incomes that have resulted from enhanced access to specific financial products appropriately designed by community SACCOs.

Lessons Learned/Potential for replication

FLT has learned that three factors significantly improve the livelihoods of Uganda’s rural farmers: (1) access to finance, (2) access to markets and (3) enhanced productivity. Efforts are needed to address these three factors simultaneously, as they are inter- related.

For example, FLT realized that farmers whose farm produce was most affected by price fluctuations were reluctant to use digital financial services to avoid transaction costs. In fact, they sometimes chose to walk long distances to avoid paying these fees. To help stabilise produce markets, FLT is upgrading its platforms to automate the value chains for fast-moving agricultural products, thereby improving market efficiency.

FLT believes that a sustainable rural economy must be community-integrated. The company’s business-to-business-to-consumer (B2B2C) business model ensures that both the farmers and the cooperatives benefit. A mutually beneficial business model for farmers and their communities is essential for sustainability andsuccess.

Next Steps

FLT is upgrading its platforms to offer banana farmers better prices through a combination of urban centrewarehousing and value chain efficiency. Stable and improved prices for agricultural products are the key incentive for farmers to adopt digital channels.

Solution Video

Solution Additional Resources

Future Link Technologies LtdLast update: 25/05/2021