Financial inclusion

The system is saving us because at times we do not even have fare to travel to the SACCO, and the long processes meant we had to visit them for two or three days before getting assistance. Now everything is done on the mobile phone.”

Peter Towett, farmer, Kapset, Kericho KenyaBACKGROUND

Lending institutions consider loans to smallholder farmers to be risky because of the lack of mechanisms for judging farmers’ creditworthiness. A credit-scoring solution can use transactional data to develop credit profiles for individual farmers, determine their probability of defaulting and assign them credit that can be disbursed to their mobile phones.

WHAT’S INVOLVED

Amtech Technologies Ltd has deployed an automated credit-scoring solution to farmer-based cooperative societies to facilitate the flow of credit to smallholder farmers. Use of alternative data, farm level and bio data is complementing the data already held by the SACCOS, helping to develop farmers’ credit profile, leading to more credit flowing to their farming activities.

EXPLORE THIS SOLUTION

- This solution enables financial institutions to use farmers’ transactional history to determine farmers’ creditworthiness and reduce lending risks.

- Farmers are also able to borrow, save, and withdraw from their SACCOs conveniently through their mobile phones.

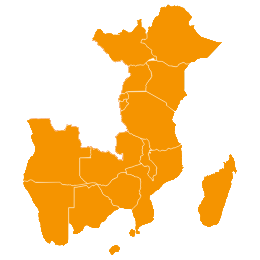

Countries involved

Kenya

Project partners

AGRA, USAID, SNV, Microsoft, Safaricom

Project dates

2018 - present

Share this solution

Bookmark this solution

BookmarkShow Full Solution

Summary

The automated credit-scoring system allows smallholder farmers to more easily access loans. The system enables savings and credit cooperative societies (SACCOs) and farmers’ organizations to access in real time farmers’ historical financial data and better determine their creditworthiness. So far, Amtech has reached 89,000 farmers, one-third of the farmers they have in their database. Amtech plans to mobilize the other two-thirds over the next two years.

Challenge/Problem

Despite being responsible for over 70 per cent of the country’s agricultural production, smallholder farmers in Kenya face a massive financing gap that prevents them from investing in day-to-day farming operations, agricultural equipment and infrastructure that can increase their productivity and incomes.

Interest rates and unattainable collateral requirements are some of the obstacles that smallholder farmers face when seeking loans from the formal banking sector. Moreover, the banks have deemed such loans risky because of the lack of mechanisms for judging the farmers’ creditworthiness. Because most smallholders have never borrowed, they lack financial profiles, which makes it prohibitively costly for financial institutions to make underwriting decisions. Financial institutions look for historical financial data such as loan repayments, savings deposit activity and other payment activity to assess the creditworthiness of a potential borrower.

In addition, commercial banks consider agriculture enterprises to be high-risk and as a result only provide approximately 4 per cent of their total loan books to the sector. Farming income is seasonal, variable and hard to predict, and financial institutions hesitate to lend to people who have unreliable and erratic income streams.

Solution

Based on the above limitations, Amtech developed a system to provide a value-added service to more than 65 farmer-based cooperatives that are already benefiting from Amtech’s information and communications technology (ICT) applications. This solution is anchored by the structured tea and dairy cooperative societies that Amtech is working with, and which serve farmers who primarily sell their crops in local markets. Amtech has deployed an automated credit-scoring solution to farmer-based cooperative societies to facilitate the flow of credit to their members. The automated credit-scoring solution uses transactional data held by farmer-based cooperative societies and farmers’ organizations to develop credit profiles for their members. The solution assigns credit scores to individual farmers, determines their likelihood of defaulting and assigns them credit that can be disbursed to their mobile phones.

The automated credit-scoring system can benefit both SACCOs and farmers. The system leads to more uniformity in decision-making, less room for bias, faster loan disbursement, enhanced controls for loan management and reduced costs from the elimination of paperwork. Because SACCOs will be linked with commercial banks to borrow money to lend to farmers, farmers will have fewer liquidity challenges and thus greater profitability.

Results

Organizations dealing in farm management systems have lots of data that financial institutions can use to more effectively include smallholder farmers. With deeper collaboration between the two groups, there can be better understanding and better packaging of solutions to farmers. Farmers’ organizations and financial service providers can better collaborate to spread not just good agronomic practices but also financial literacy, which can serve as a foundation for moving smallholders into the formal banking systems.

So far, Amtech has reached 89,000 farmers, which is 33 per cent of the farmers in their database. Amtech plans to mobilize the remaining 67 per cent in the next two years. In the areas where Amtech has deployed the solution, production has been doubled. In Lelchego, for example, advances taken by farmers to pay for feed purchases and farm improvements have greatly increased production. The farmers’ incomes have doubled in the last six months, enhancing their food security. Amtech has reached 84 SACCOs, with the majority of co-operators being women and youth. To date, they have issued loans amounting to US$674,000. Amtech’s main objective is to reach all 288,000 farmers currently in their database.

Lessons Learned

The success of the automated credit-scoring system depends on the strength of the organizations using it. Given the recent collapse of major SACCOs in Kenya due to poor leadership, members should be trained on the qualities to look for in the leaders they elect. In addition, all board members should be trained on the intervention, as implementation can be delayed if key decision-makers do not fully understand the program. Over-reliance on county governments can also cause further delays as cooperatives wait upon donors and partners.

Additionally, it is important for organizations to have a plan. Because some groups lacked capacity to prepare budgets and work plans, they engaged in activities that seemed promising but ended up trapping their resources. For example, one group invested in a large milk-processing equipment whose capacity is currently under-utilized, leading to more expensive idle capacity.

Next Steps

In the next six months, Amtech will use radio and other channels to sensitize farmers on the need to join SACCOs and enrol in the automated credit-scoring system. They also intend to roll out the solution across Kenya so that more farmers can increase their production and earn more income. They are also negotiating with the county governments of Nandi and Trans Nzoia to capture farm-level data in a single server. Beyond Kenya, there are ongoing negotiations to provide services to the Oromo Cooperative in Ethiopia and the Sindika Cooperative in Ruvuma region, Tanzania.

Solution Additional Resources

AMTECH Technologies LtdLast update: 28/05/2021